Happy Spring!

This past March—Women’s History Month—we launched our new and improved website. We’ve got an updated logo, a new color palette (rivaling a Spring tulip garden!) and a whole new way of showcasing our portfolio companies, the emerging funds we partner with, and the insights and expertise we want to share with you (on the GingerSnaps blog, of course).

It’s a reflection of how we’ve blossomed — both as a firm and as part of a vibrant, growing ecosystem of founders and funders. Please check it out and let us know what you think.

Speaking of funders…

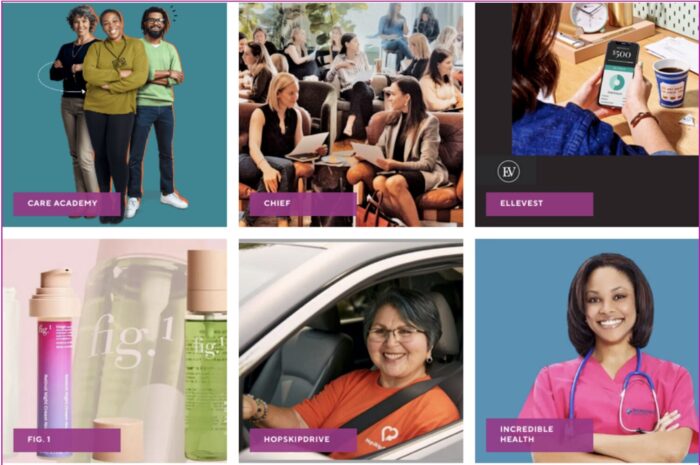

Our new website includes snapshots of the funds in which GingerBreadCap is an LP (now 25+) — with a special spotlight on our homepage of companies we’ve co-invested in with our partner funds.

First up: our co-investment with BBG Ventures in Spring Health, which helps employers provide behavioral health benefits to their employees. BBG Ventures, founded in 2014 by Susan Lyne and Nisha Dua, was one of the first funds we partnered with, when we could count on one hand the number of funds devoted to investing in female founders.

Linnea Roberts

Upside of the Downturn

|

Toward a More Inclusive Capitalism

Our mission puts us in great company. Earlier this year, we were honored to be recognized on the inaugural DEIC Power100 list. Compiled by Blueprint Capital Advisors, the Power100 comprises leaders in  venture capital and asset management who are committed to Diversity, Equity, and Inclusive Capitalism.

venture capital and asset management who are committed to Diversity, Equity, and Inclusive Capitalism.

We shared the spotlight with a number of our partner funds, including Cake Ventures, Ulu Ventures, Precursor Ventures, Harlem Capital and Female Founders Fund. Find them all profiled here.

New Investments, Portfolio Company Highlights, Upcoming Events

Lots more to share with you!